About SAR

Shaping the Kingdom for Over Five Decades

Founded in 1975G and headquartered in Riyadh, Saleh Abdulaziz Al Rashed & Sons Company (“SAR” or the “Company”) a key Saudi provider of integrated construction materials, mining, and industrial spare-parts solutions in the Kingdom of Saudi Arabia (the “Kingdom”).

Over 5 decades, the Company has evolved from a single quarry in Riyadh to a vertically integrated multi-product, multi-region operator and prides itself on its disciplined strategy and consistent execution which has enabled it to deliver landmark projects across the Kingdom.

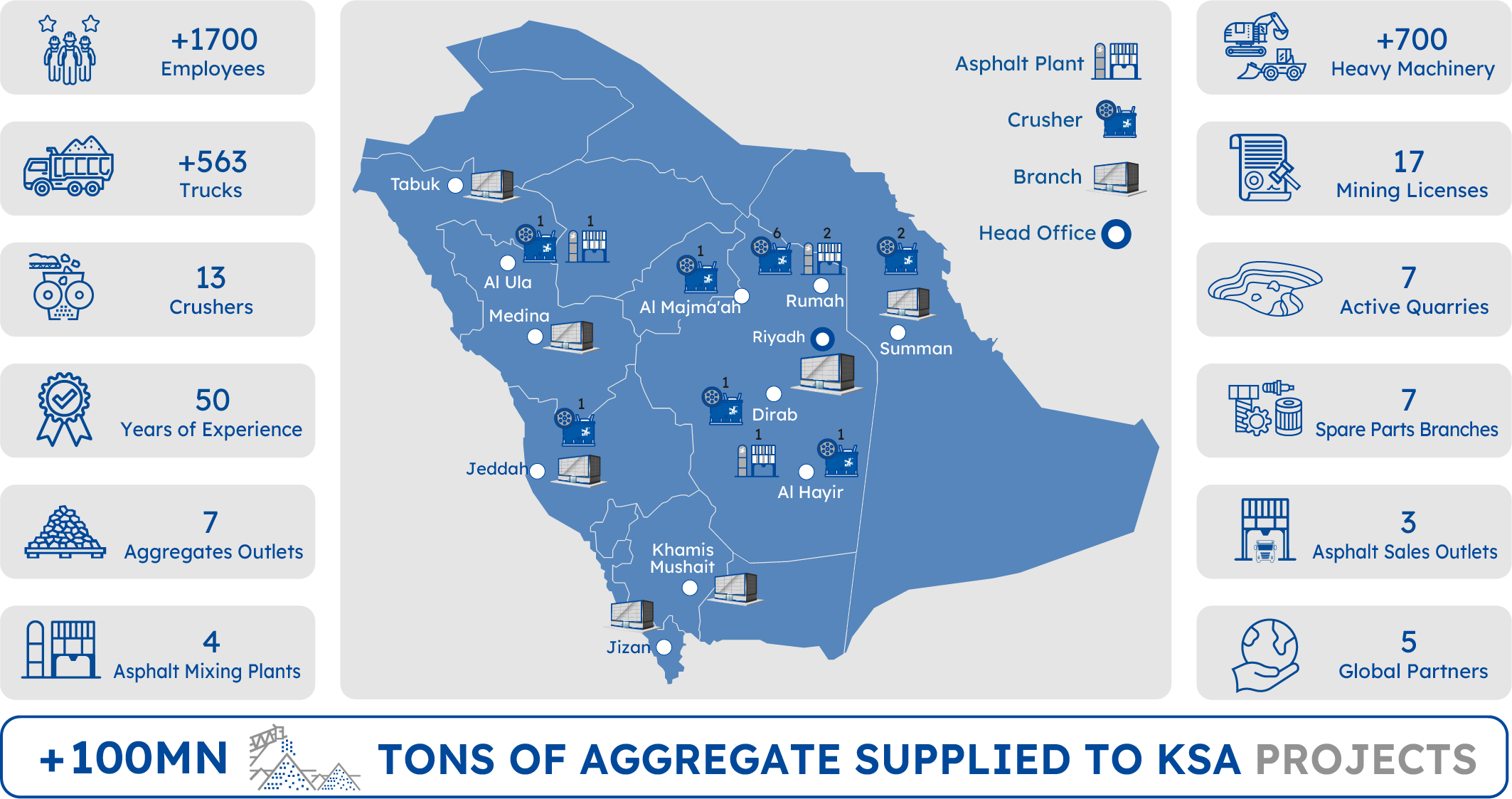

As of 31 March 2025G, SAR operated 7 quarry sites including 13 crushers, 4 asphalt mixing plants, and a fleet of around 563 trucks and 700 heavy machinery units, supported by 17 wholesale outlets across the Kingdom. This integrated asset base enables end-to-end control across the value chain, from quarrying and production to logistics and after-sales service, ensuring reliability, efficiency, and quality across operations.

SAR holds a 28% market share for aggregates in Riyadh as of year-end of 2024G, underscoring its strong competitive position. The Company continues to expand its capacity and geographic reach, adding new quarries and asphalt plants to meet rising national demand. It has also entered the silica-sand segment, having secured two Category B exploration licences and applied for extraction licences. This strategic diversification enables SAR to supply high-growth sectors such as glass manufacturing, coatings, water filtration, construction materials, and high-tech industrial applications, supporting long-term revenue growth and vertical integration.

The Company’s long-term mining licences and regulatory approvals ensure operational continuity, with reserves sufficient for 15 to 20 years of extraction across key regions including Riyadh, the Eastern Province, and Madinah.

Aligned with Vision 2030, SAR’s growth strategy focuses on capacity expansion, product diversification, regional growth, and digital transformation. Key initiatives include deploying high-efficiency crushers, expanding asphalt production, introducing SAP-based analytics and predictive maintenance, and strengthening logistics and supply chain efficiency to enhance performance and transparency.

SAR is equally committed to updating its operations in line with environmental, social and corporate governance (ESG) standards to support long-term sustainability and regulatory compliance. Key initiatives include expanding the adoption of renewable energy across quarry operations and water management systems, implementing dust filtration across crushers, and making additional investments in reforestation and land rehabilitation.

The Company is also increasing use of recycled aggregates and energy-efficient machinery, while maintaining compliance with ISO 9001:2015 (Quality Management), ISO 14001:2015 (Environmental Management), and ISO 45001:2018 (Occupational Health and Safety) standards and securing all necessary environmental permits. These efforts reflect SAR’s commitment to environmental standards, sustainability, and its role in supporting economic diversification under Vision 2030.

Abdulaziz Saleh Abdulaziz Al Rashed

Chairman Message

This marks an important moment in SAR’s five-decade journey of growth and contribution to the Kingdom’s industrial and infrastructure development. Our Company has evolved from a family business into one of Saudi Arabia’s leading providers of construction materials and mining solutions.

The IPO is a natural progression that reflects our confidence in SAR’s fundamentals, governance, and the opportunities that lie ahead under Vision 2030. We remain committed to driving operational excellence, expanding our portfolio, and creating enduring value for our stakeholders.

CEO Message

The intention to list SAR marks a defining milestone in our operational growth story and a strong validation of our integrated business model. Our vertically integrated platform, spanning quarrying, production, logistics, and distribution, has enabled us to consistently deliver quality, efficiency, and reliability to our partners across the Kingdom of Saudi Arabia.

As we enter this new phase, we will continue to build on our strengths by expanding capacity, diversifying products, and accelerating digital transformation. We remain committed to operational excellence and to supporting the Kingdom’s infrastructure and industrial ambitions with sustainable, value-driven solutions.

Saud Abdulaziz Saleh Al Rashed

SAR in Numbers

Investment Highlights

Capitalizing on a Strong Macroeconomic Backdrop and Robust Industry Growth

Saudi Arabia’s strong economic fundamentals and ambitious Vision 2030G agenda provide a compelling backdrop for the Group’s growth. The Kingdom’s focus on economic diversification, infrastructure development, and private sector empowerment is driving sustained demand for construction materials, mining, and heavy equipment-core sectors for the Group.

Key Macroeconomic Drivers:

- Robust Gross Domestic Product (GDP) Growth: Saudi Arabia’s GDP grew at a 10.3% Compound Annual Growth Rate (CAGR) from 2020G to 2024G, reaching SAR 4.09 trillion, and is projected to expand further at 3.8% CAGR to SAR 5.12 trillion from 2025G to 2030G.

- Government Spending Momentum: Government expenditure rose from SAR 1.08 trillion in 2020G to SAR 1.35 trillion by 2024G, reflecting a 5.7% CAGR.

- Strong Gross Value Added (GVA) Performance: Overall GVA grew at a 9.8% CAGR from SAR 2.64 trillion in 2020G to SAR 3.84 trillion in 2024G.

- Strong Sectoral Expansion:

- GVA Construction: Expanded from SAR 160 billion in 2020G to SAR 216 billion in 2024G at a 7.7% CAGR.

- GVA Manufacturing: Rose up from SAR 348 billion in 2020G to SAR 639 billion in 2024G, reflecting a 16.4% CAGR.

- GVA Mining & Quarrying: Recorded strong growth, increasing from SAR 536 billion in 2020G to SAR 1.02 trillion in 2024G at a 17.4% CAGR.

Mining Sector Momentum:

- Aggregate Market: The market saw strong growth, rising from SAR 4.5 billion in 2020G to SAR 8.5 billion in 2024G at a 17.1% CAGR, and is poised for continued expansion, reaching SAR 14.0 billion by 2030G at 8.7% CAGR.

- Asphalt Market: The market experienced substantial growth, expanding from SAR 5.5 billion in 2020G to SAR 14.5 billion in 2024G, reflecting a robust CAGR of 27.1%. Looking ahead, growth is expected to moderate, reaching SAR 19.9 billion by 2030G at a projected CAGR of 5.5%.

- Spare Parts Market: The segment demonstrated consistent growth, rising from SAR 0.6 billion in 2020G to SAR 0.8 billion in 2024G, representing a CAGR of 6.5%, and projected to reach SAR 1.0 billion by 2030G at 3.5% CAGR.

These trends highlight strong demand for construction inputs and maintenance services, underpinned by ongoing infrastructure projects and mining activity.

Infrastructure & Construction Demand:

- Transport & Infrastructure Focus:

- SAR 40 billion allocated to infrastructure and transport in 2024G.

- Over 1,000 projects with a combined value of SAR 608 billion.

- Introduction of the Saudi Road Code to standardize quality and safety.

- Ranked 4th among G20 for road infrastructure quality.

Strategic Implications for SAR:

- Positioned to benefit from rising demand for aggregates, asphalt, and spare parts.

- Expansion strategies include:

- Widening sales network.

- Diversifying product offerings.

- Enhancing logistics and distribution.

- Aligned with national priorities to support infrastructure and economic transformation.

Key Player in the Saudi Mining and Construction Materials Sector

SAR is one of the leading players in Saudi Arabia’s mining and construction materials sector, with a strong reputation built over more than five decades of proven industry experience. It offers a diversified portfolio of products and services that are critical to the Kingdom’s infrastructure and industrial development.

- Aggregates: The Group supplies a wide variety of aggregates essential for road building, concrete manufacturing, and large-scale infrastructure projects. With a 28% market share in Riyadh, the Group is one of the key players in the Kingdom’s most active construction markets.

- Asphalt: Through advanced production capabilities, the Group delivers high-quality asphalt mixtures for road construction and major infrastructure works.

- Spare Parts: Complementing its core materials business, the Group specializes in trading high-performance spare parts for crushers and material handling systems.

The Company’s integrated offering and long-standing expertise position it as a trusted partner in enabling Saudi Arabia’s infrastructure growth, fully aligned with Vision 2030 objectives.

End-to-End Vertical Integration: Maximizing Value Creation

SAR operates a fully integrated business model that spans the entire value chain - from exploration to production, supply chain, and after-sales support. This structure drives operational efficiency, cost optimization, and consistent product quality, enabling SAR to deliver exceptional value to shareholders and exceed customer expectations.

- Exploration: SAR undertakes comprehensive resource identification and feasibility studies, supported by advanced geological surveys, drilling, and sampling techniques. This ensures a reliable pipeline of raw materials for long-term operations.

- Production: Leveraging state-of-the-art blasting and excavation techniques, the Group extracts, processes, and refines raw materials with advanced technology to deliver consistent, high-quality output.

- Supply Chain & Logistics: The Group maintains a robust logistics network, including procurement of spare parts, supplier relationship management, and timely, secure delivery. Network optimization and inventory management further enhance reliability and cost efficiency.

- Business Continuity: Through prudent financial management, strong maintenance capabilities, and a commitment to safety and environmental standards, the Group ensures uninterrupted operations and builds trusted partnerships.

This integrated approach has delivered tangible benefits, including a 30% reduction in transportation costs in 2024G, while supporting diversified revenue streams across aggregates, asphalt, and spare parts.

With 17 strategically located sites, a fleet of 560+ trucks, and over 700 heavy equipment units, SAR is uniquely positioned to maintain its leadership in the Saudi mining and construction materials sector.

Demonstrated Track Record of Strong Financial Performance

Between 2022G and 2024G, SAR’s revenue grew by 18.3% on a CAGR basis to reach SAR 599.6 million from SAR 429.5 million.

As of 30 September 2025G, the company reported revenue of SAR 545.4 million, gross profit of SAR 118.6 million, and net income of SAR 66.1 million, translating to a net margin of 12.1%. EBITDA for the period stood at SAR 115.6 million, reflecting strong operational performance and cost efficiency.

Operational efficiency also improved, with returns on average assets (ROAA) of 16.3% and returns on average equity (ROAE) of 23.2% for the trailing twelve months as of September, highlighting SAR’s effective capital deployment and cost discipline.

The Company maintained a solid liquidity position, holding SAR 18.6 million in cash, and a prudent capital structure with a debt-to-equity ratio below 0.1x.

SAR continues to benefit from steady demand across its core markets, robust cash generation, and disciplined cost management - further reinforcing the Company’s resilience and financial strength as it advances toward its planned listing on the Main Market of the Saudi Exchange.

Strong Growth Fueled by Targeted Initiatives with Clear Levers for Future Growth

SAR has delivered robust operational growth over the past three years, driven by strategic investments and capacity expansion. Between 2022G and Q1 2025G, SAR achieved significant increases across key metrics:

- Asphalt Mixing Plants: Expanded from 2 to 4 plants, doubling capacity to meet rising infrastructure demand.

- Quarries: Grew from 3 to 7 active quarries, enhancing raw material availability and geographic reach.

- Transportation Fleet: Increased the number of trucks by 278%, from 149 to 563, ensuring timely and secure delivery across the Kingdom.

- Crushers: Expanded crushers by 63%, from 8 to 13, supporting higher aggregate production volumes.

- Heavy Equipment: Grew fleet size by 92%, from 365 units to 700 units, reinforcing operational efficiency.

- Employees: Workforce expanded by 27%, reflecting the Group’s commitment to scaling operations while maintaining quality and safety standards.

This growth trajectory is underpinned by a clear roadmap for future expansion, focusing on:

- Market Share Expansion: Adding new aggregate quarries and additional asphalt plants to boost capacity and efficiency.

- Broadened Offerings: Introducing high-quality silica sand and calcium carbonate production, alongside low-emission asphalt and sustainable building materials.

- Enhanced Distribution & Logistics: Expanding transportation fleet, optimizing supply chain efficiency, and increasing warehousing and distribution capabilities.

These initiatives position the Group for continued revenue growth, margin enhancement, and operational excellence, reinforcing its recognized market leadership in Saudi Arabia’s construction materials sector.

Strong Governance Standards and a Management Team with a Proven Track Record

SAR applies strong governance policies and risk frameworks, including financial risk assessments, cybersecurity and supply chain risk mitigation.

Experienced Leadership and Skilled Workforce

The Group’s success is driven by experienced leadership and a highly skilled workforce across its core business lines.

Leadership with Proven Industry Experience

The Group’s Executive Management team brings deep sector experience, driving strategy, innovation and continuous improvement. Their leadership supports market adaptation and stakeholder confidence.

Skilled Workforce with Strong Technical Capabilities

The Group invests in technical training and Saudisation programmes to support operational excellence and align with Vision 2030. This commitment enhances employee retention and long-term sustainability.

The Group’s integrated business model, financial strength, ESG adherence and human capital position it for long-term growth aligned with the Kingdom’s infrastructure and development goals.

Key Documents

Key IPO Figures

Offer Size:

ordinary shares (30% of Company’s total issued share capital)

Retail Allocation

Up to 30% of total offering size

Listing

Main Market of the Saudi Exchange

Share Capital:

(18.6 million shares at SAR 10 each)

Institutional Allocation

Minimum of 70%

Offering Type

Secondary sale by existing shareholders

FAQs

FAQs

01. Why invest in SAR's IPO?

SAR is a key Saudi provider of integrated construction materials, mining, and industrial spare-parts solutions in KSA. With over 50 years of operational experience, nationwide scale, exclusive distribution agreements, and strong alignment with Saudi Vision 2030 infrastructure and mining initiatives, SAR offers investors a unique opportunity to participate in a business positioned for sustainable growth and long-term value creation.

02. What is the rationale for this share offering?

The IPO enables existing shareholders to partially monetize their holdings while broadening SAR’s shareholder base and increasing visibility through a listing. The Company itself will not receive proceeds, but the Offering is expected to strengthen SAR’s market profile, governance, and financial flexibility as it enters its next phase of growth.

03. What percentage of SAR will be listed?

30% of the Company’s share capital, equivalent to 5,580,000 ordinary shares, will be listed on the Main Market of the Saudi Exchange.

04. When will SAR commence trading?

Trading on the Saudi Exchange Main Market is expected to begin after the final allocation of shares and completion of all legal and regulatory procedures. The exact date will be announced in due course.

05. What will the dividend policy be?

The declaration and distribution of dividends will be recommended by the Board of Directors before being approved by the Shareholders at a General Assembly meeting. Any dividend distribution will depend on, amongst other things, the Company’s historic and anticipated earnings and cash flows, financing and capital requirements and market and general economic conditions, the Company’s Zakat position and legal and regulatory considerations.

06. How will SAR use the proceeds of the IPO?

The Net Offering Proceeds will be distributed to the Selling Shareholders. The Company will not receive any part of the proceeds from the Offering. The Selling Shareholders will bear all fees, costs and expenses in relation to the Offering.

07. When will I be able to buy shares?

Eligible individual investors may subscribe during the retail subscription period via the receiving agents.

08. How will shares be allocated between institutional and retail investors

- Minimum of 70% (3,906,000 shares) for institutional investors.

- Up to 30% (1,674,000 shares) for retail investors.

09. What is the price per share?

The offering price will be determined following the completion of the Institutional book-building period.10. What is the lock-up period for existing shareholders?

The Substantial Shareholders and the Shareholder Acting in Concert are subject to a Lock-up Period of six (6) months from the date on which trading of the Offer Shares on the Exchange commences. They may not dispose of any of their Shares during such period. Following the end of the Lock-up Period, the Substantial Shareholders and the Shareholder Acting in Concert may dispose of their Shares without the need to obtain prior approval from the authority.

Board of Directors

Abdulaziz S. Al Rashed

Salah Khaled A. AlTuwaijri

Khaled Abdul Rahman M. AlMousa

Abdul Aziz Abdul Rahman A. AlRashed

Abdullah Muhammad A. AlRashed

Saud A. Al Rashed

Leadership Team

Saud A. Al Rashed

Mohamed ElShahat Ayad

Faisal A. Al Rashed

Dr. Ahmed Magdy Hamdy

Mohammed A. Al Rashed

Mohammed M. AlAttas

Mohammed Salah

IPO Timeline

20

January

01-05

February

12-17

February

No later than 24

February

No later than 26

February

To be confirmed

Who can participate in the IPO?

Tranche (A) Participating Parties: Comprising the parties entitled to participate in the book-building process specified under the Book-Building issued by the Capital Market Authority.

This includes investment fund, GCC and Foreign Corporate Investors. The number of Offer Shares to be provisionally allocated to the Participating Parties is five million five hundred eighty thousand (5,580,000) Offer Shares, representing one hundred per cent. (100%) of the Offer Shares. The final allocation will be made after the end of the Individual Subscriber’s subscription, by ANB Capital Company in coordination with the Company using the discretionary allocation mechanism. As a result, some of the Participating Entities may not be allocated any Offer Shares.

The Financial Advisor shall have the right, if there is sufficient demand by Individual Subscribers and in coordination with the Company, to reduce the number of Offer Shares allocated to Participating Entities to three million nine hundred and six thousand (3,906,000) Offer Shares, representing seventy per cent. (70%) of the Offer Shares.

Tranche (B) Individual Subscribers: Comprising Saudi Arabian natural persons (including any Saudi female divorcee or widow with minor children from a marriage to a non-Saudi person who can subscribe for her own benefit or in the names of her minor children, on the condition that she proves that she is a divorcee or widow and the mother of her minor Saudi Arabian children), GCC natural persons, foreign natural persons either residing or not residing in the Kingdom. A subscription for Offer Shares made by a person in the name of his divorced wife shall be deemed invalid and the applicant shall be subject to the sanctions prescribed by law.

If a duplicate subscription is made, the second subscription will be considered void and only the first subscription will be accepted. A maximum of one million six hundred and seventy-four thousand (1,674,000) Offer Shares representing thirty per cent. (30%) of the total Offer Shares shall be allocated to Individual Subscribers.

If the Individual Subscribers do not subscribe in full to the Offer Shares allocated to them, the Financial Advisor may in coordination with the Company reduce the number of Offer Shares allocated to Individual Subscribers in proportion to the number of Offer Shares subscribed by them.

How to Subscribe?

Step 1

Investment account and an active portfolio with one of the Receiving Agents

To participate in the SAR IPO, you must first open an investment (trading) account with a CMA-licensed bank or broker. This account authorizes you to subscribe to IPOs and trade shares on the Saudi Exchange (Main Market). Once your account is open and active, you will be eligible to apply for IPO shares during the Offering Period.

Step 2

Review the Prospectus and IPO materials

Carefully review the Prospectus and supporting documents available on this IPO webpage. The Prospectus contains all material information about SAR and the Offering, enabling you to make an informed investment decision.

Step 3

Submit your subscription application

During the Offering Period, Subscription Application Forms will be made available by the Receiving Agents. These must be completed in line with the instructions set out in Section 16 (Subscription Terms and Conditions) of the Prospectus. Individual Subscribers may also apply through the websites, mobile applications, and electronic channels of the Receiving Agents that offer such services.